Posts

If or not your’lso are attempting to test the fresh seas having a gambling establishment or are unsure in the spending on line, these types of casinos deliver the finest in on the internet playing – just for $step 1. Visibility limitsFDIC insurance policies just talks about the primary number of the brand new Computer game and you will any accrued attention. Much more basically, FDIC insurance coverage limitations apply to aggregate quantity for the put, for each membership, at each and every protected establishment. Investors should think about the fresh the total amount that almost every other membership, deposits or accumulated interest will get exceed appropriate FDIC constraints. Whether or not financial servicers often assemble tax and you may insurance (T&I), these profile is separately maintained and never felt home loan upkeep account to own put insurance policies motives. T&I dumps get into the newest debtor’s pending percentage of its a property fees and you can/or assets advanced on the taxing expert otherwise insurer.

- Across the board, our expertly examined $step 1 deposit gambling enterprises keep experience from a single (or higher) of one’s more than bodies to incorporate Kiwis prominent managed real money gaming environment.

- In the last number of years, Jenn have triggered Forbes Mentor and you can many fintech enterprises.

- Since the Ally Financial Bank account try a significant higher-yield account by itself, you may enjoy more benefits if you too provides a keen Ally Lender Paying Membership (Ally’s family savings equipment).

- As the 2017, they have assessed more 700 gambling enterprises, examined over step 1,500 gambling games, and written over 50 gambling on line guides.

- Even though many Americans were upset the next bullet of stimulus checks was smaller than the initial, will still be an unexpected increase of money which are lay so you can a play with.

Home loan Upkeep Profile

The new 2025 Soda an average of can also add in the $50 to each month-to-month work for take a look at, on the average commission inside ascending to help you $1,976 monthly. Inside Oct, the new Social Shelter Administration place the 2025 cost-of-way of life changes during the dos.5%, the littlest yearly Cola hike while the 2021. The newest Cola will be based upon current inflation costs, and since speed hikes provides cooled off from their pandemic highest, the elderly are getting a smaller sized benefit improve for the next year. Because the January step 1 are a federal getaway, the newest January 2025 SSI fee was sent to readers to your December 30, depending on the Societal Defense Administration.

Rates history for Jenius Bank’s family savings

The brand new FDIC assures a deceased person’s membership as if the individual were still real time to possess six months after the death of the fresh membership proprietor. In this elegance months, the insurance of one’s proprietor’s profile will not changes unless the new accounts is restructured from the those people signed up to do so. As well as, the new FDIC does not pertain it elegance several months, whether it do cause smaller exposure. The newest computation of publicity per P&We membership are separate should your home loan servicer or financial trader has generated numerous P&We accounts in the same bank.

Rates records for Bread Savings’s family savings

The brand new Spouse’s ownership express throughout mutual membership in the bank translates to ½ of your own joint account (otherwise $250,000), thus their display is actually totally insured. The newest Partner’s possession show in every mutual accounts from the financial means ½ of your shared account (otherwise $250,000), very their share try fully insured. Membership kept on the label away from a sole proprietorship aren’t insured lower than it possession group. Alternatively, he or she is insured because the Single Account dumps of one’s proprietor, added to the brand new user’s other Single Accounts, or no, at the same bank and the total insured to $250,000. For example, the brand new FDIC assures dumps owned by a great homeowners’ connection at the one to insured financial to $250,100000 altogether, not $250,000 for each and every member of the fresh relationship.

Scheduling a secondary Just adopted Easier which have Princess Cruise trips $1 Deposit Provide

Understand now’s offers costs as well as the APYs institutions currently offer to the government financing speed planned. The fresh Citizens Availability https://happy-gambler.com/7-sins/ Checking account also offers a great step 3.70% APY, no monthly charge and you may a good $0.01 minimal beginning deposit requirements. It account shines for smooth cellular financial having a highly rated mobile software. Without monthly fee, minimal deposit specifications otherwise nonsufficient fund percentage, you can start preserving that have people balance without having to worry regarding the fees offsetting the attention you get. Focus substances daily as there are zero limitation for the matter out of distributions or transfers you can make.

Mohegan Sun Local casino – Initiate Playing just for $step 1

Having cost slower trending down, it would be a while up until loan providers begin providing desire prices anywhere near 7%. As of mid-Summer, futures areas are rates inside an over 85% opportunity the newest Provided stays subjected to the summer months, depending on the CME FedWatch Device. The signed up and you can regulated online casino doing work in the us demands at least put before you get started with actual-money playing.

It used to be a rule that you may merely withdraw or transfer cash-out away from a premier-produce family savings to half a dozen minutes per month without having to pay one charge. Since the pandemic, however, it rule is finished and is also now up to for each and every bank’s discernment to decide how often savers is also withdraw. Extremely financial institutions features caught compared to that six-times-per-month laws, while others allow you to make limitless withdrawals at no cost. Not simply do your finances earn a far greater come back within the a high-give family savings than in antique savings, however have usage of your cash if you want it as you would inside the an everyday savings account. Your bank account inside the a leading-give bank account try federally insured because of the FDIC otherwise NCUA, meaning that places around $250,100000 are safe if the lender was to suddenly collapse. A high-give savings account feels as though a regular checking account however, also provides increased focus price, or APY, on your own dollars.

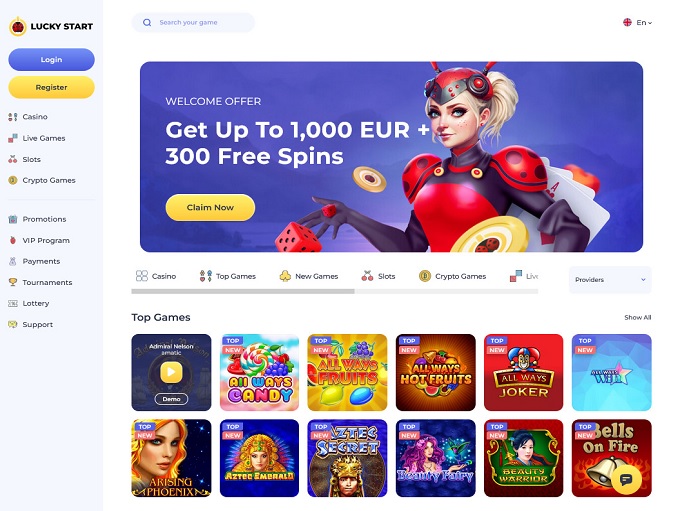

Welcome added bonus

Even as we try and provide a wide range of now offers, Bankrate doesn’t come with factual statements about all the economic or credit equipment or services. Guess just how much your money you will grow over the years that have a great high-yield savings account. Cds are best for people looking a guaranteed price away from go back that is usually higher than a bank account. In return for a top rate, financing try fastened to own a set time and early detachment punishment will get implement. Occasionally, you can instantaneously access the money you placed through Automatic teller machine. You may also just have immediate access to help you an element of the money, according to the consider’s proportions.

Large productivity banking companies encourage might need large minimum deposits to start a free account or secure the gorgeous APY. Ensure one lowest is a cost you’re safe placing on the a good savings account. Sometimes, there are also limits one to limit the buck matter that may earn the newest highest APY, for this reason limiting their attention-earning prospective.