Blogs

Certification away from put accounts can be handy to own saving for the long-term needs or potentially making a high interest than your do with a bank account. If you are using Dvds within your savings method, it’s you’ll be able to to use them to functions around FDIC insurance coverage limits due to CDARS. The new Government Put Insurance rates Corporation (FDIC) guarantees places placed in discounts profile, money business profile, checking account and Dvds. This means if you bank from the an insured institution, your bank account are protected in the event of a lender inability—at the least to a certain degree. Even as we discussed earlier, very online casinos require you to create at the very least $10 whenever placing for your requirements. All of our professional publishers only have been able to choose one zero minimum put real money internet casino in the usa.

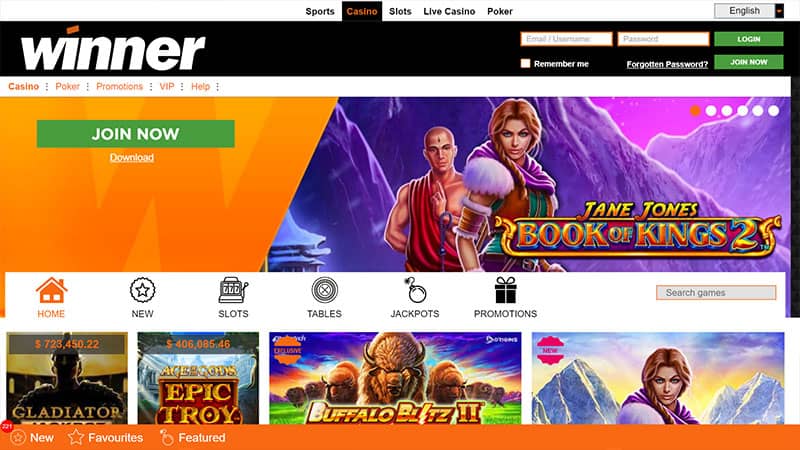

Dumps within the a banking business pursuant on the provisions of the subdivision might be made in a banking company having a location of business in the county. Read on for the best gaming sites having lower lowest dumps. Register one website that fits your own gaming has to appreciate a high quality on line sense. Our very own required $step one put gambling enterprises for new professionals offer a pleasant incentive you to you could make use of after you register.

Examining Accounts

However,, a corporate with repeated modest-to-large-size of purchases might not appear impractical to receive otherwise shell out $10,one hundred thousand inside checks, even if the number continues to be advertised for the Internal revenue service. To amplify FDIC coverage past $250,100000, depositors provides another possibilities as well as trust profile. We have to found the request at least three (3) business days through to the percentage is scheduled as made.

Alternatively, he could be insured while the Solitary Account places of your proprietor, put in the brand new customer’s other Unmarried Accounts, if any, in one bank and also the full covered to $250,000. For example, in the event the a firm provides one another an operating membership and you may a hold membership at the same financial, the newest FDIC manage create each other accounts with her and you can insure the fresh dumps to $250,100. Such as places are insured on their own regarding the personal places of one’s business’s people, stockholders, couples or participants. Alternating the application of “or,” “and” otherwise “and/or” to separate your lives the new names from co-people inside the a joint account term, as well as will not change the level of insurance policies provided. If all these requirements is actually met, for each co-owner’s offers of any joint membership that he or she is the owner of in one covered bank is extra together with her as well as the full is insured to $250,100000. A shared Account try a deposit owned by several people with zero beneficiaries.

Common $step one Deposit Local casino Incentive Mistakes

This can be a social Shelter count, driver’s license, or government-given ID. This informative article need to be acquired whether the depositor features a free happy-gambler.com proceed the link account during the finding standard bank. Government rules needs banking companies in order to declaration dumps of greater than $10,one hundred thousand. Irrespective of where the money originated from or as to the reasons it’s getting placed, the bank need to statement they from the filing a great Money Transaction Statement (CTR). For each beneficiary is eligible for approximately $250,100 within the FDIC exposure for each and every membership proprietor.

Yet not, of numerous personal casinos provide every day sign on bonuses, which offer several Gold coins and sometimes a great Sweeps Coin. Of numerous $step one minimal put incentives could only be used to the specific games. Make sure to investigate terms and conditions of each venture meticulously to learn and that games be eligible for your added bonus. Very online casino incentives feature betting standards ranging from 1x to help you 100x. It indicates you must choice a specific amount before withdrawing the fresh added bonus.

- Observe that in the issues away from a financial inability in which a great depositor already has dumps from the acquiring lender, the newest half a dozen-few days grace months revealed could affect the dumps.

- Should your declaration on the first lender is complete, begin once more together with your next financial etc, if you do not provides a report per financial in which you features deposit profile.

- Bankrate.com is actually an independent, advertising-supported author and you will evaluation service.

- Crown Coins is additionally extremely ample with bonuses for brand new and existing players possesses a progressive daily login bonus one to begins in the 5,000 CC.

- The downtown area Vehicle parking Butt’letter, 95 Ariz. 98, 101 (1963) (quoting Domus Realty Corp. v. 3440 Realty Co., 40 Letter.Y.S.2d 69, (Special Label 1943)).

Particular institutions have started to give up to $3 million from FDIC insurance rates.

We would refuse to unlock an account for any excuse, and no reason. We are not accountable for any damage otherwise debts as a result of refusal out of a free account matchmaking. Profile belonging to the same corporation, relationship, otherwise unincorporated relationship but appointed a variety of aim commonly individually covered. A single-12 months Computer game having a performance from cuatro% APY brings in $500, as the same Video game having a 1% APY produces $a hundred plus one that have 0.10% APY earns $ten.

Sweepstakes gambling establishment commission steps

All the Cds need $step 1,one hundred thousand to start (or $75,100 for many who opt for a good jumbo Video game, and that pays somewhat higher APYs). The credit connection and doesn’t have a maximum count you could set up a Computer game. Alliant doesn’t render people specialty Dvds such as zero-penalty or knock-right up Cds. Anyone can join Alliant Borrowing Union; registration isn’t minimal. It could be helpful to make sure to keep cash and you can debit card PIN safer when using an automatic teller machine in public. Choosing an atm within the a proper-lit town and becoming conscious of your own land may go a long distance to your getting secure and make a profit put or withdrawal.

Having fun with Leading edge Bucks Put mode your money is eligible to possess FDIC insurance. And some federal and state-chartered credit unions provide a lot more private insurance rates as a result of A lot of Display Insurance rates, an insurance coverage business within the Kansas. But unlike exposure from the NCUSIF, it insurance policy is maybe not protected because of the You.S. bodies. However, not what you at the financial is part of FDIC shelter. Money points including holds, securities and you can shared fund aren’t protected, even although you purchased them through your financial. The new FDIC and doesn’t insure cryptocurrencies, the brand new contents of safe-deposit packets, term life insurance, annuities otherwise municipal securities.

Including, the fresh FDIC makes sure deposits owned by a homeowners’ connection during the you to definitely covered lender around $250,100 in total, perhaps not $250,100 for each and every member of the new relationship. To possess Trust Account, the term “owner” does mean the brand new grantor, settlor, or trustor of one’s faith. “Self-directed” ensures that bundle people feel the straight to direct how the money is spent, like the capacity to head you to definitely places be placed in the an FDIC-covered bank. At the most major financial institutions, bucks dumps is actually credited instantly however if you are presenting far more than simply $5,100, the lending company might wish to wait briefly. Additional matter to be familiar with is exactly what the new bank’s finance access rules is for bucks deposits.

A lot more on-line casino resources

Although also provides need a little financing, internet casino incentives vary centered on their tips. As an example, having a “100% complement in order to $1,000” greeting venture, you could found an advantage equivalent to the minimum put necessary. The fresh department is also revising criteria for informal revocable trusts, known as payable to your dying account. In past times, those accounts had to be titled which have a term including “payable on the death,” to gain access to faith exposure constraints. Now, the new FDIC will not have that demands and you will as an alternative just need financial facts to spot beneficiaries getting experienced relaxed trusts.

And sustain in mind one to a Cd’s fixed speed may well not continually be enough to manage your own cash facing rising cost of living. The newest government put insurance policies limitation lived in the $100,one hundred thousand for nearly thirty years prior to Congress ultimately elevated it within the reaction to the brand new worst overall economy while the High Anxiety. It’s meant to guarantees you and your fellow users the financial carries FDIC deposit insurance, and therefore protects your deposits as much as appropriate courtroom constraints if the bank walk out business. Chase along with costs their organization consumers a purchase percentage for cash deposits more than the brand new month-to-month limitation. While you are we have witnessed a chat out of financial institutions billing customers charges to own and make dollars dumps, not one of your own significant banking companies has implemented this sort of coverage thus far. Of a lot brokerages also provide brokered Dvds of other banking institutions all over the country, therefore it is easy to sit in this FDIC constraints when you’re possibly making greatest cost.